May 24, 2025

Written by: Theodora Mladenova

Landscape Finance

As the world grapples with escalating environmental challenges, Landscape Finance emerges as a transformative approach that integrates ecological restoration with economic development. By mobilising diverse financial resources, it aims to regenerate ecosystems, bolster communities, and create sustainable economic opportunities.

What Is Landscape Finance?

Landscape Finance is a strategic framework that mobilises financial resources to support large-scale, integrated land and seascape restoration. It combines public, private, and philanthropic funding to implement nature-based solutions that yield environmental, social, and economic benefits. This approach transcends traditional conservation efforts by embedding financial sustainability into ecological restoration initiatives.

Organisations like the Landscape Finance Lab and Commonland are at the forefront of this movement, developing models that align ecological health with economic incentives.

Why It Matters

Traditional conservation funding often falls short in addressing the scale of environmental challenges. Landscape Finance addresses this gap by:

- Attracting Diverse Investments: By demonstrating tangible returns—be it carbon credits, sustainable commodities, or ecotourism—projects become attractive to a broad spectrum of investors.

- Enhancing Community Resilience: Integrating local communities ensures that restoration efforts are culturally appropriate and economically beneficial, fostering long-term stewardship.

- Promoting Policy Alignment: By aligning restoration projects with national and international policies, such as the UN Sustainable Development Goals, Landscape Finance ensures broader support and scalability.

Blended Finance: De-risking Restoration Investments

Blended finance is a cornerstone of Landscape Finance, strategically combining public, philanthropic, and private capital to fund restoration projects. This approach mitigates investment risks and attracts private investors to initiatives that might otherwise be deemed too risky.

Case Study: Peatland Finance Ireland

Peatland Finance Ireland (PFI) is developing an innovative, multi-stakeholder model for funding and rewarding peatland restoration. Ireland’s peatlands, covering up to 1.5 million hectares, are significant carbon sinks. However, degradation has turned them into carbon sources, emitting over 2.3 million tonnes of CO₂ annually. PFI aims to establish a national financing system for peatland restoration, involving government, communities, and various sectors. The initiative aligns with Ireland’s Climate Action Plan and the EU Nature Restoration Law, offering a model for commercially viable, community-led restoration that contributes to national emissions and biodiversity targets.

Case Study: Dutch Fund for Climate and Development (DFCD)

The DFCD, with an initial commitment of €160 million from the Dutch Ministry of Foreign Affairs, supports climate adaptation and mitigation projects in developing countries. Managed by a consortium including FMO, WWF-NL, SNV, and Climate Fund Managers, the DFCD focuses on water management, sustainable forestry, ecosystems, coastal management, and climate-smart agriculture. By providing grants and technical assistance, the DFCD helps projects become bankable, facilitating large-scale funding and promoting climate-resilient economies.

Case Study: WaterLANDS Project

WaterLANDS (Water-based solutions for carbon storage, people, and wilderness) is a €23.6 million EU-funded project aiming to restore over 10,500 hectares of degraded wetlands across Europe. Led by University College Dublin, the project involves 32 partners from 14 countries. WaterLANDS combines scientific research with community engagement, employing a community-led paradigm in the co-design of restoration efforts. The project also explores innovative governance models and financial solutions to overcome barriers to wetland restoration. Notably, in the Venice Lagoon, the project integrates ecological restoration with cultural renewal, involving local artists and schoolchildren to foster a deeper connection between communities and their natural environment.

Holistic Landscape Restoration: Integrating Nature and Infrastructure

Holistic landscape restoration goes beyond ecological recovery by integrating social, economic, and infrastructural elements. This approach acknowledges the interconnectedness of human and natural systems, aiming for sustainable and resilient landscapes.

Combining Green and Grey Infrastructure

Traditional ‘grey’ infrastructure—such as roads and dams—can be complemented with ‘green’ infrastructure like wetlands and forests to enhance climate resilience. For instance, integrating mangroves with seawalls can provide more effective coastal protection than either alone. This synergy not only reduces costs but also delivers ecological and social benefits.

Public Finance’s Role

Public finance plays a pivotal role in advancing holistic landscape restoration. By redirecting funds towards projects that integrate environmental and social objectives, governments can catalyse large-scale restoration efforts. The EU’s Nature Restoration Law exemplifies this by promoting investments that combine grey and green infrastructure for sustainable development.

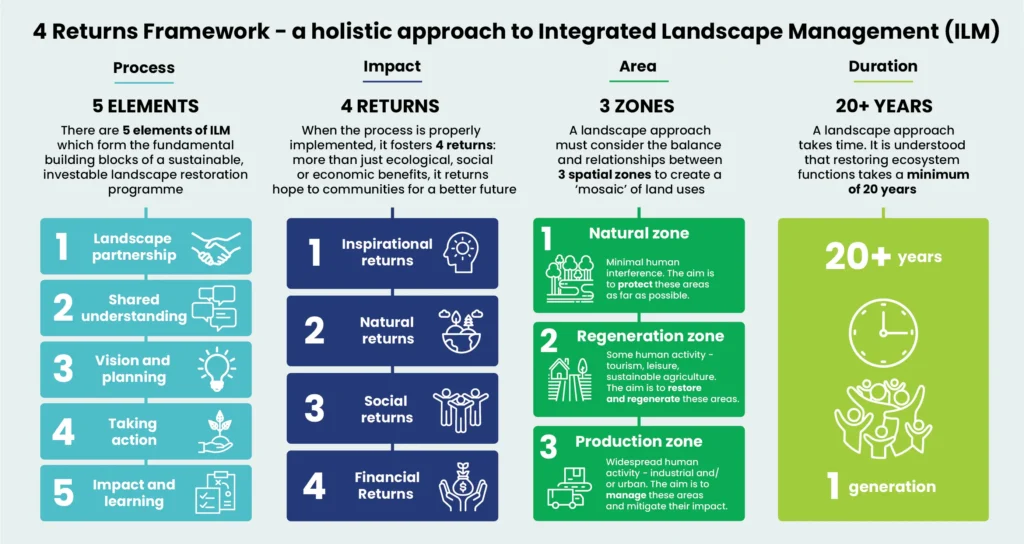

The 4 Returns Framework

Developed by Commonland, the 4 Returns Framework underpins many Landscape Finance projects. It focuses on delivering:

- Inspiration: Fostering hope and purpose within communities.

- Social Capital: Strengthening relationships and community cohesion.

- Natural Capital: Restoring biodiversity and ecosystem services.

- Financial Capital: Generating sustainable economic returns.

This holistic approach ensures that restoration efforts are sustainable, inclusive, and impactful. Download the Scorecard Template here.

Looking Ahead

As the urgency to address environmental challenges grows, Landscape Finance offers a scalable and sustainable pathway forward. By aligning ecological restoration with economic incentives, it transforms degraded landscapes into thriving ecosystems and resilient communities.

For investors, policymakers, and communities alike, embracing Landscape Finance is not just an environmental imperative but an opportunity to build a more sustainable and equitable future.

Sources:

[1] https://commonland.com/

[2] https://commonland.com/wp-content/uploads/2023/12/UTF-8Commonland-Financing20Holistic20Landscape20Restoration_0220Digital.pdf

[3] https://landscapefinancelab.org/

[4] https://www.climate-kic.org/news/the-role-of-public-finance-in-advancing-holistic-landscape-restoration/

[5] WaterLANDS: https://waterlands.eu/project-overview/

[6] WaterLANDS: https://www.v-i-t-a-l.org/en/journal/eu-green-deal-a-venezia-il-progetto-waterlands

[7] Peatland Finance Ireland: https://landscapefinancelab.org/featured-landscapes/peatland-finance-ireland

[8] DFCD: https://www.thedfcd.com/files/dfcd-of-factsheet-v6-1-.pdf

[9] DFCD: https://www.government.nl/documents/publications/2018/11/19/grant-application-dfcd

[10] Landscape Finance Lab 5 Elements Scorecard template: https://4returns.commonland.com/wp-content/uploads/2024/04/landscape-finance-lab-5-elements-scorecard-template-1712177784149.pdf

[11] Somewhat related to look at: https://landuseimpacthub.com/en