April 30, 2024 (Updated: June 11, 2025)

Written by: Theodora Mladenova

Blended Finance: Catalyzing Sustainable Development

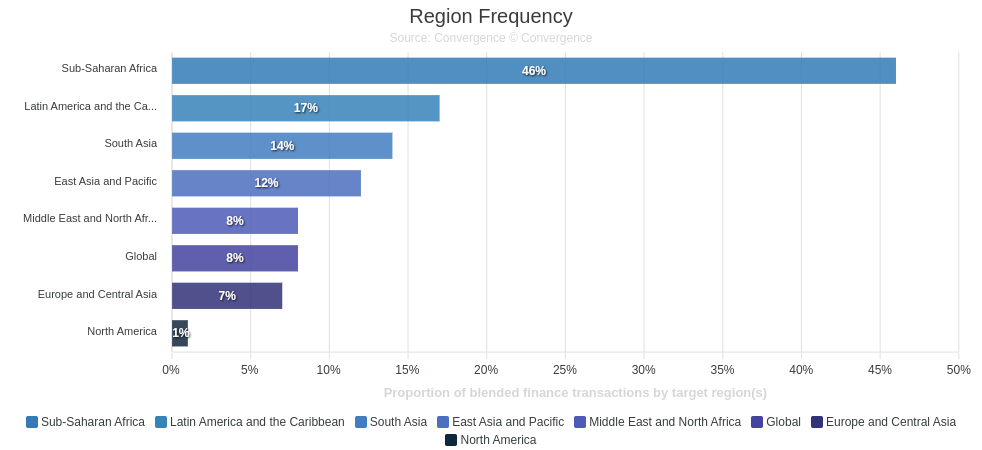

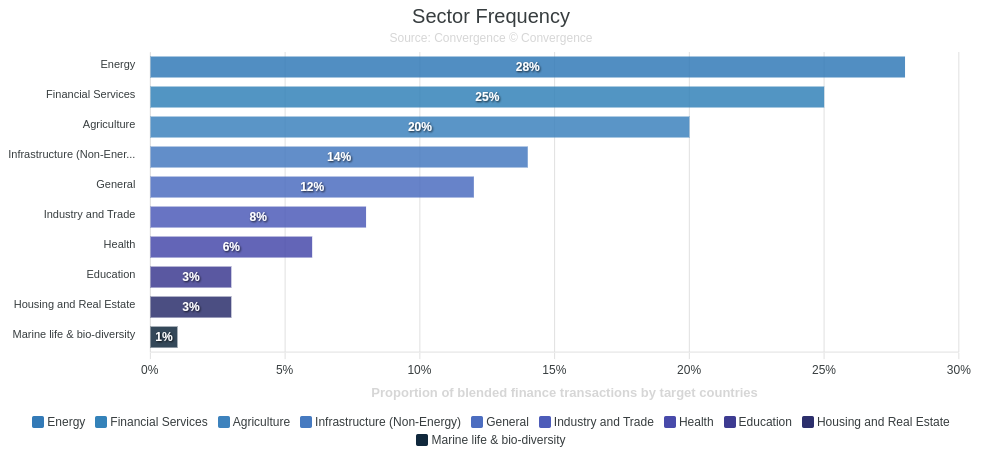

Blended finance has become a vital tool in the quest for sustainable development, leveraging the strengths of both public and private sectors to address pressing global challenges. This innovative financial approach entails the strategic use of public and philanthropic funds to catalyze private investment into projects that yield social, environmental, and economic benefits. By de-risking and thereby increasing private investment in areas such as renewable energy, education and infrastructure, blended finance platforms are able to increase the positive social and environmental impact of development programs.

The use of blended finance can be traced back to the early 2000s with the Monterrey Consensus of 2002 and the Addis Ababa Action Agenda of 2015. Institutions like the World Bank, the International Finance Corporation (IFC), and various development finance institutions (DFIs) such as FinDev Canada have since spearheaded efforts to craft mechanisms that blend public and private funds. While blended finance is not a novel concept, it has become increasingly relevant in recent years, given the widening gap between the need for resources to meet the UN Sustainable Development Goals (SDGs) and the availability of public funding.

Mechanisms and Structures

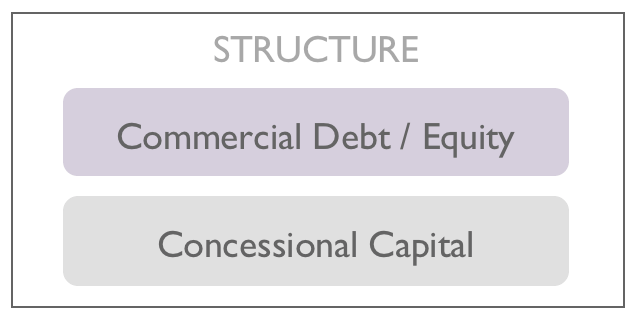

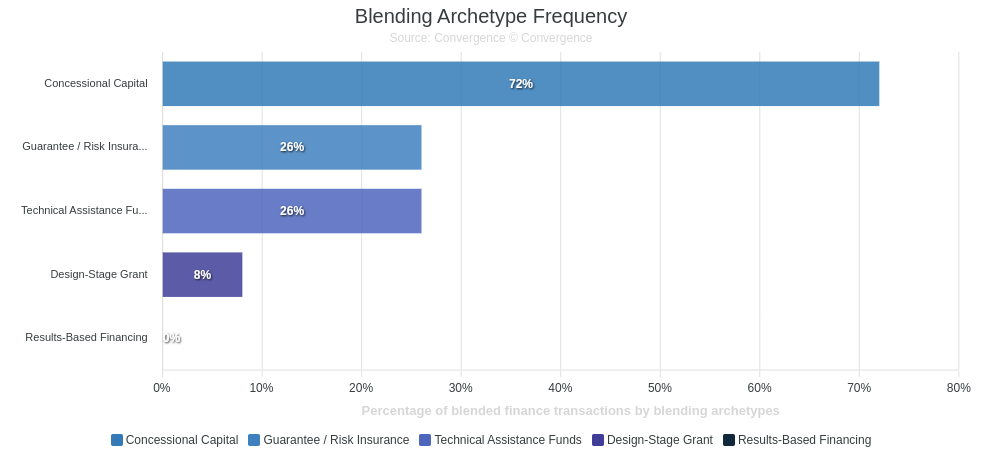

Blended finance structures typically involve a tiered funding approach, where different types of capital are deployed in a manner that aligns the interests of various stakeholders.

Concessional Finance

These are funds provided at below-market rates, often by DFIs or philanthropic organisations, to make projects more attractive to private investors by improving the risk-return profile. This might look like public and philanthropic investors assuming subordinate equity positions, bearing initial losses to shield senior private investors from downside risk. Concessional funds are provided within the capital structure.

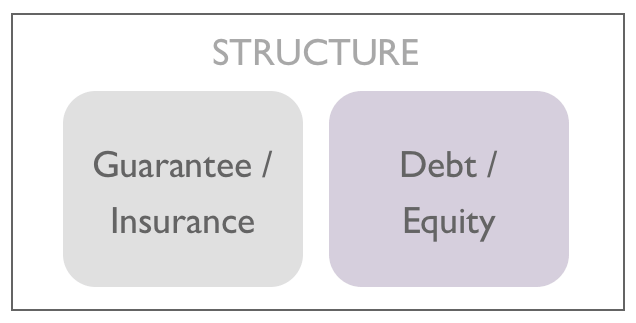

Guarantees and Risk Insurance

By providing guarantees or insurance against potential losses, public entities can alleviate some of the risks that deter private investment, particularly in volatile markets.

Development guarantees are diverse tools used in blended finance to mitigate credit and political risk, with institutions like USAID, Sida, GuarantCo, and MIGA playing key roles in their deployment. These guarantees are often partial and typically cover commercial debt, particularly in infrastructure and renewable energy projects. According to recent data, 40% of blended finance deals using development guarantees focus on energy, especially renewables, with East Asia and South Asia being primary geographic targets. Commercial banks are the most responsive to these guarantees, making up half of private sector participants in such transactions, though institutional investors remain largely unmobilised. Despite their effectiveness in certain contexts, development guarantees are not universally applicable and require more evidence to fully assess their efficiency and broader impact, especially in underrepresented sectors like agriculture and healthcare.

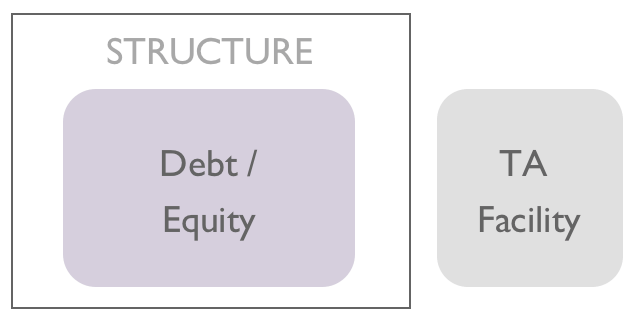

Technical Assistance

Grants or concessional funds are often used to provide technical assistance, helping to prepare projects, build capacity, and improve the overall investment environment. These can also be deployed after the investment to enhance both the project’s commercial viability and its developmental impact.

Technical assistance (TA) is a crucial and flexible component in blended finance, used in 34% of transactions to enhance both impact and financial viability, particularly in developing countries. It is most commonly applied post-investment (53%) for activities like ESG integration and capacity building, but also supports pre-investment efforts (28%) such as pipeline development, and to a lesser extent, cost subsidies and enabling environment reforms. TA is most prevalent in low-income countries and regions like Sub-Saharan Africa and the Middle East and North Africa. Public sector actors like DFIs, MDBs, and agencies like USAID and IFC are the dominant funders, while private sector contributions remain limited.

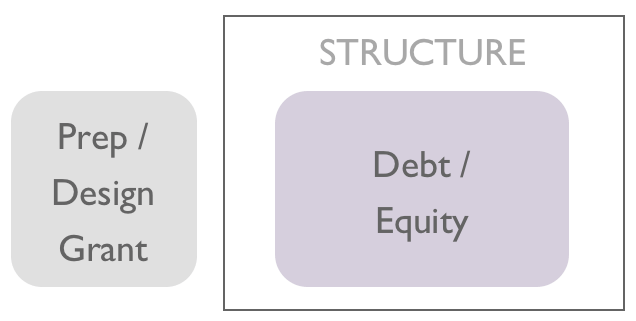

Design Funding

Specific to Convergence, but could be employed by others. Design funding is a specialised market acceleration initiative that offers early-stage grant support specifically for the development of innovative blended finance structures. While blended finance holds significant promise, many transactions are inherently complex, resource-intensive, and costly to structure and implement. This funding is intended to ease those barriers by enabling organisations to design solutions that, though often too risky or complicated to pursue alone, have strong potential to mobilise private capital at scale if successfully executed.

These instruments, when skilfully combined, can significantly amplify the impact of each dollar invested, driving substantial progress towards sustainable development goals.

Case Studies

Global Energy Efficiency and Renewable Energy Fund (GEEREF)

Managed by the European Investment Bank, GEEREF is a public-private partnership that mobilises private investment in renewable energy and energy efficiency projects in developing countries. By providing risk capital and technical assistance, GEEREF has successfully attracted private investors and catalysed significant additional funding. Learn more here.

International Finance Corporation’s (IFC) Blended Finance Facility

IFC leverages donor funds to de-risk investments in sectors such as agribusiness, health, and education. For example, the IFC has used blended finance to support the development of affordable healthcare facilities in Sub-Saharan Africa, reducing investor risk and enabling access to essential services. Learn more here.

Green Climate Fund (GCF)

Established within the framework of the United Nations Framework Convention on Climate Change (UNFCCC), the GCF uses blended finance to catalyze climate investments in developing countries. The GCF deploys a mix of grants, concessional loans, equity investments, and guarantees to reduce the financial risks associated with climate projects, thereby encouraging private sector participation. Learn more here.

Global Financing Facility (GFF)

The World Bank–supported and country-led international development initiative mobilizes private capital to support maternal and child health in developing countries. By leveraging donor contributions to attract private investment, the GFF has been able to fund critical health initiatives that would have otherwise struggled to secure financing. Learn more here.

Rewa Solar Power Project

The World Bank provided a $648 million loan along with guarantees to cover the debt service of this 750MW solar project in Rewa, Madhya Pradesh, India. This attracted substantial private investment resulting in one of the world’s largest single-site solar power plants. Learn more here.

GAIA

A collaboration between FinDev Canada and Mitsubishi UFJ Financial Group, Inc (MUFG), GAIA is a climate blended finance platform designed to mitigate risks associated with climate change. With investments into climate change mitigation and adaptation. It’s projected to reach nearly 20 million people across 25 developing and emerging countries. Learn more here

Challenges and Opportunities

While blended finance holds great promise, it also faces several challenges:

Complexity: Structuring blended finance deals can be complex, requiring coordination among multiple stakeholders with different objectives and risk appetites.

Measurement and Evaluation: Assessing the impact and effectiveness of blended finance projects can be challenging, necessitating robust monitoring and evaluation frameworks.

Scalability: Scaling blended finance solutions to address the vast funding gap for sustainable development requires significant resources and innovative approaches.

Despite these challenges, the potential of blended finance to drive sustainable development is immense. By aligning public and private interests, blended finance can unlock substantial capital flows, foster innovation, and accelerate progress towards achieving the SDGs.

Blended finance on the national and local levels

Blended finance approaches are often employed on the local level, in sectors or geographical areas where the risk-return ratio is unsatisfactory to private investors without the additional incentives to mitigate risks. In Canada, for example, we see government and philanthropic-led initiatives in rural and Northern territories. These initiatives align with national development priorities in housing, small business, and other sectors. Philanthropic organizations and family offices are increasingly exploring blended investment structures in under-serviced communities.

Final Thoughts

Blended finance is a critical mechanism for catalyzing sustainable development. By strategically combining public, philanthropic, and private capital, this approach can mitigate risks, enhance returns, and mobilize the resources needed to address the world’s most pressing challenges. As stakeholders continue to collaborate and innovate, blended finance has the potential to transform the development landscape, creating a more sustainable and inclusive future for all.

Sources:

[1] Convergence (2020). “The State of Blended Finance 2020.” Link

[2] World Economic Forum (2015). “Blended Finance Vol. 1: A Primer for Development Finance and Philanthropic Funders.” Link

[3] International Finance Corporation (2020). “Blended Finance at IFC.” Link

[4] FinDev Canada (2023). “GAIA – a climate and blended finance platform – gains momentum at Paris Summit For A New Financing Pact.” Link

[5] Monterrey Consensus: “Monterrey Consensus of the International Conference on Financing for Development.” United Nations, March 2002. Link

[6] Addis Ababa Action Agenda: “Addis Ababa Action Agenda of the Third International Conference on Financing for Development.” United Nations, July 2015. Link

[7] Global Financing Facility: “Global Financing Facility.” World Bank. Link

[8] Green Climate Fund: “Green Climate Fund.” United Nations Framework Convention on Climate Change (UNFCCC). Link

[9] Rewa Solar Power Project: “Rewa Solar Project.” NS Energy. Link

[10] World Bank on Blended Finance: “Blended Concessional Finance: Scaling Up Private Investment in Lower-Income Countries.” World Bank, November 2018. Link

[11] Global Energy Efficiency and Renewable Energy Fund (GEEREF). Link