I provide tailored consulting to help founders create fundable, impactful ventures and guide investors toward opportunities that generate meaningful social and financial returns.

Take a look at my consulting portfolio.

for Founders

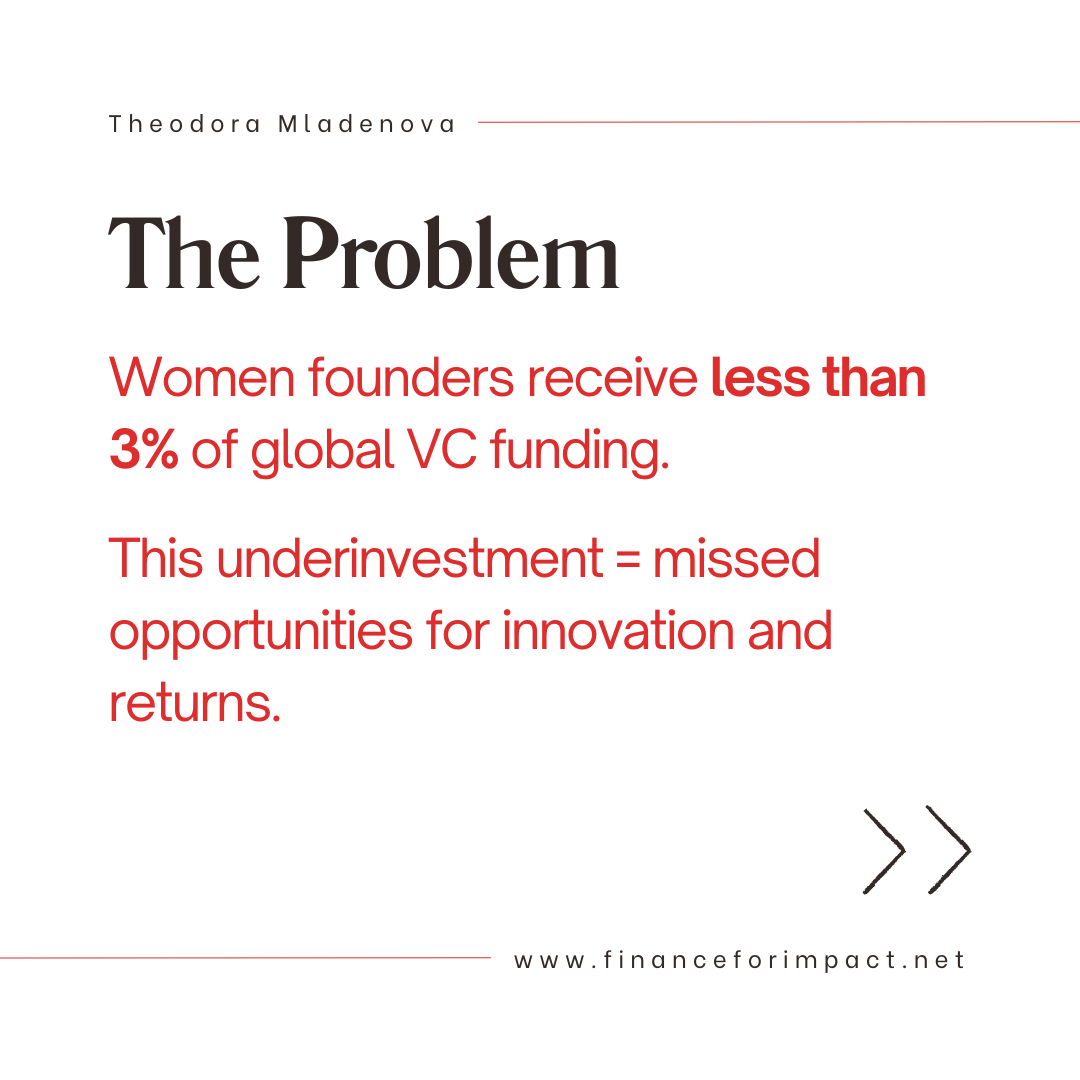

for Investors

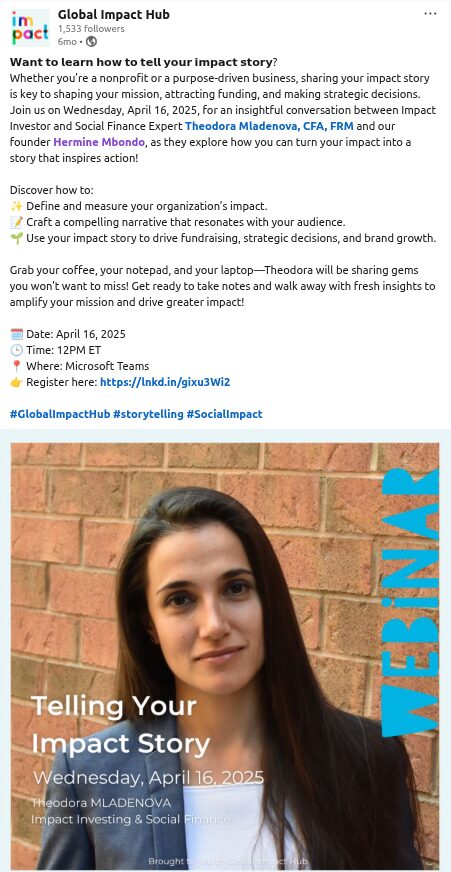

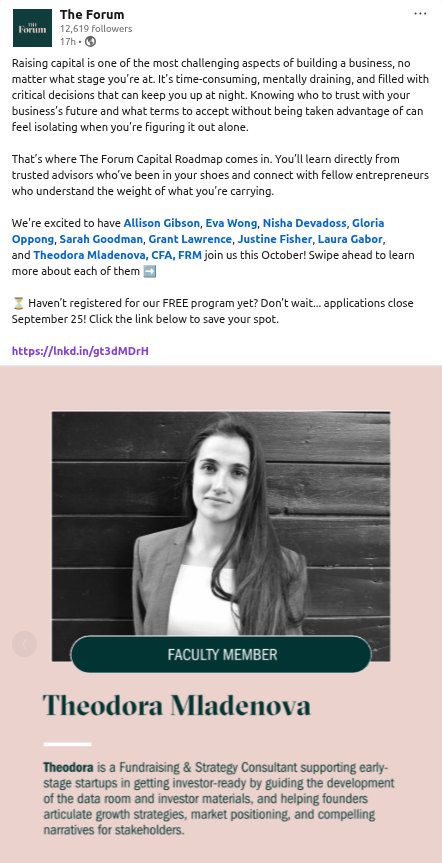

Speaking engagements: